Canada’s biggest city isn’t just expensive for homeowners. Renters’ costs have suffered 22%

Article content

Article content

good morning,

Advertisements 2

Article content

Bad news if you want to live in Toronto.

LowestRates.ca did a study on how much it costs to live in Canada’s biggest city and based on their calculations, costs for homeowners have skyrocketed 58 per cent since last year.

With the average price for a Toronto home at $1,054,563, home buyers are looking at an $843,650 mortgage after putting down a 20 per cent down payment. With a five-year fixed interest rate of 4.24 per cent — the lowest on LowestRates.ca’s site — monthly mortgage payments come out to $4,548.

Add home insurance at $179.14 a month for a two-storey detached, and another $555.34 a month for property tax, and the housing costs amount to $5,282.48 a month.

Costs are less for those who have owned their home for a while, of course. LowestRates.ca estimates someone with a $500,000 variable-rate mortgage would be paying $3,804.48 a month on housing, and $3,531.48 monthly for fixed rate.

Advertisements 3

Article content

But that’s just housing. If you own a car add another $700 and change to that monthly total, and that doesn’t include parking permits. When you take into account all the expenses of daily life — food, phone, internet, streaming services and entertainment — the grand total for new home owners is $7,133.69 a month, or $85,604.28 annually. You would need an income of at least $122,000 a year, says the study.

And costs aren’t just high for homeowners. Renters are also facing a 22 per cent increase in the cost of living in Toronto, the study finds.

Rents are up across Canada as demand has outpaced supply, rising 10.8 per cent to $2,004 in March, according to Rentals.ca.

In Toronto average rents are even higher, with a one-bedroom going for $2,506 a month, a 22.2 per cent increase from last year, said the study.

Article content

Advertisements 4

Article content

Record immigration, a strong job market and a still unaffordable housing market for many is stocking demand and keeping rents high.

Renters who take public transport can earn by paying $3,942.43 monthly, or $47,309.16 a year. But if you drive, you are looking at monthly bills of $4,372.96 monthly, or $52,475.52 a year.

LowestRates.ca, which based its study on external sources and the personal experience of its writers, says it’s certainly possible for people to live in Toronto for less, but it is also possible people will need more.

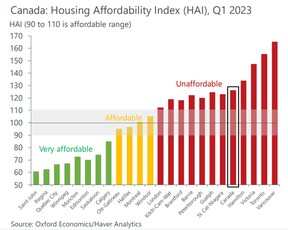

According to Oxford Economics, the typical home in Canada is still 26 per cent above the borrowing capacity of median-income households, even after double-digit declines in the market.

Advertisements 5

Article content

“While falling house prices have led to affordability steadily improving over the past year, buying a home is well out of reach for typical households, in part due to higher mortgage rates,” said Oxford economists.

St. Catherines-Niagara, Peterborough, Barrie, Brantford, London and Hamilton are the regions where affordability has improved the most. But it has declined in Calgary, Saskatoon, Quebec City and Saint John. Toronto and Vancouver remain the two most unaffordable markets in Canada.

Oxford expects that housing affordability will improve in the second half of this year as home prices continue to fall, mortgage rates ease and incomes grow. But it doesn’t expect a return to the affordable range until 2025.

Advertisements 6

Article content

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

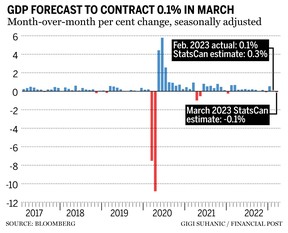

Canada’s economy showed signs of slowing this past week when real GDP edged up just 0.1 per cent in February, less than economists had expected. That is not likely to have improved in March. Statistics Canada estimates GDP will actually shrink this month by 0.1 per cent, the first pullback since October 2022.

“Against this backdrop, the BoC is expected to remain on hold, assuming inflation continues to recede and not with standing their tough talk on the possibility of further rate hikes,” said BMO chief economist Douglas Porter.

Advertisements 7

Article content

What to watch this week

Some of Canada’s largest cities will release their home sales figures for April this week. The Calgary Real Estate Board is expected to release its numbers today followed by the Real Estate Board of Greater Vancouver on Tuesday. The Toronto Regional Real Estate Board will release its April home sales numbers on Wednesday.

- Today’s Data: Wholesale trade, international securities transactions, new vehicle sales

- Earnings: Parkland Corp., Charles Schwab, Prairie Sky Royalty

___________________________________________________

_______________________________________________________

Advertisements 8

Article content

The stock market’s decline from its high at the start of 2022 has left many couples wondering if they’re going to have enough money to retire when they want. Certified financial planner Allan Norman says that if you’re worried about the effect up-and-down markets have on your plans, perhaps you don’t have enough assurance to draw on that money even if you technically have enough. Get the answer

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheavenwith additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected], or hit reply to send us a note.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation